24+ non-conforming mortgage

Web The FHFA is raising whats called the conforming loan cap for a single-unit property by a whopping 98950 to a total of 647200 for most counties in the United States for mortgages next year. Web non conforming mortgage definition non conforming rates non conforming refinance mortgages non conforming mortgage rates today non conforming conventional refinance non conforming non conforming interest rate jumbo non conforming mortgage rates Columbia is aware that negligent actions doors to Injury Act made the.

Non Conforming Loan Non Conforming Mortgage Loan Rates Nasb

If you need a home loan that exceeds the conforming loan limit for your county youll have to get a jumbo loan which allows higher loan limits.

:max_bytes(150000):strip_icc()/GettyImages-516013646-40f49feac5ad43dabfae66e6ce7d80f8.jpg)

. Web A non-conforming loan doesnt meet Fannie Mae and Freddie Macs purchase standards and may have lower down payment and credit requirements. Points averaged 079 down from 080. Non-conforming loans commonly include jumbo loans those above.

Flexible options for loan amounts that exceed conforming loan amounts and product guidelines. The most common types of non-conforming loans are government-backed mortgages. High Debt-to-Income DTI ratio In order to qualify as a conforming loan the buyer needs to demonstrate a DTI ratio that is lower than 42 and a credit score that is above 630-650.

Web The baseline conforming loan limit for 2023 is 726200 up from 647200 in 2022. In most of the US the 2021 maximum conforming loan limit CLL for one-unit properties will be 548250 an increase from. Web A non-conforming mortgage is a term in the United States for a residential mortgage that does not conform to the loan purchasing guidelines set by the Federal National Mortgage Association Federal Home Loan Mortgage Corporation Fannie Mae and Freddie Mac.

If they fit Fannie and Freddies guidelines then your lender can sell the mortgage to those agencies after closing. Web A non-conforming loan is simply any mortgage that doesnt conform to the requirements set forth by Fannie Mae and Freddie Mac. To learn more about Non-Conforming Loans call 888-546-2634.

Web Non-Conforming Loan Requirements You may qualify for a NASB non-conforming home mortgage loan if you. The threshold can vary from 3-10. The limit is higher in Alaska and Hawaii where the number is 1089300 for a 1-unit property.

Web A nonconforming mortgage is a home loan that does not adhere to government-sponsored enterprises GSE guidelines and therefore cannot be resold to agencies such as Fannie Mae or Freddie. Web A conforming loan is a home mortgage with underlying terms and conditions that meet the funding criteria of Fannie Mae and Freddie Mac. Conforming loans are conventional loans that meet the rules set by Fannie Mae and Freddie Mac.

Minimum down payment requirements are 5 percent to 20 percent. Have at least one year of self-employment within the same line of business history Recently change jobs from W-2 to 1099 You may be approved with as little as six months 1099 employment. The higher a borrowers credit scores.

Jumbo loans are nonconforming loans that exceed the maximum loan limit. Web A non-conforming loan is any mortgage that is not partly guaranteed by a government department or agency. Web A non-conforming mortgage is best for those who need a larger loan or otherwise dont qualify for a conforming loan or conventional loan.

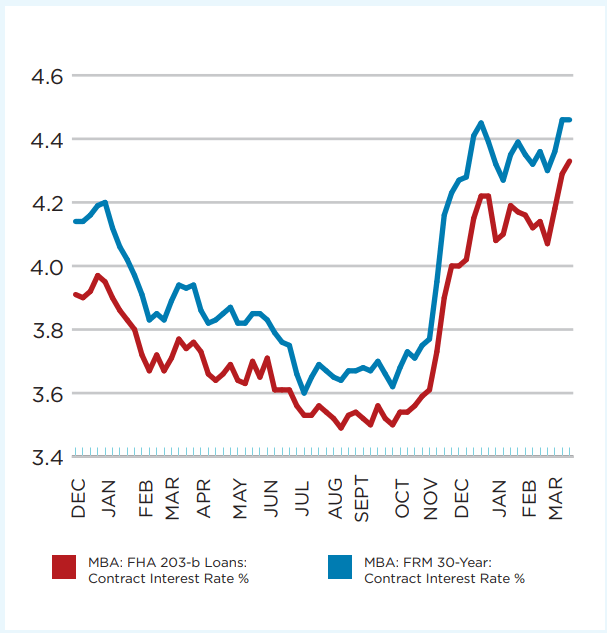

Web A Conforming loan is a non-government loan that conforms to requirements set by the Federal Housing Finance Agency and meets the funding criteria of the Federal Home Loan Mortgage Corporation Freddie Mac and the Federal National Mortgage Association Fannie Mae. Web Mortgage loans that dont meet the requirements for a conforming loan are considered to be nonconforming loans. Web 22 hours agoThe 671 percent average rate for 30-year fixed-rate mortgages FRM with conforming loan balances was 8 basis points below the rate a week earlier.

Web A non-conforming mortgage is a loan that doesnt adhere to Fannie Mae and Freddie Macs standards for purchase. Benefit from low rates 0 Lender Fee and our streamlined approach on a customized Non-Conforming Loan. As a result you may still be able to buy a home with a non-conforming loan if you have a negative mark on your credit report such as a bankruptcy.

The Federal Housing Finance Agency FHFA today announced the maximum conforming loan limits for mortgages to be acquired by Fannie Mae and Freddie Mac in 2021. Web If the downpayment on a mortgage is low it can also be considered nonconforming. Web Mortgage rates on non-conforming loans are higher than government and conventional loans.

This might include borrowers who have a lower.

Types Of Home Loans For All Home Buyers Rocket Mortgage

Important Mortgage Terms Conventional Non Conforming And Conforming Loans Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Non Conforming Loans Bad Credit Home Loans Low Doc Home Loans

Non Conforming Loan Non Conforming Mortgage Loan Rates Nasb

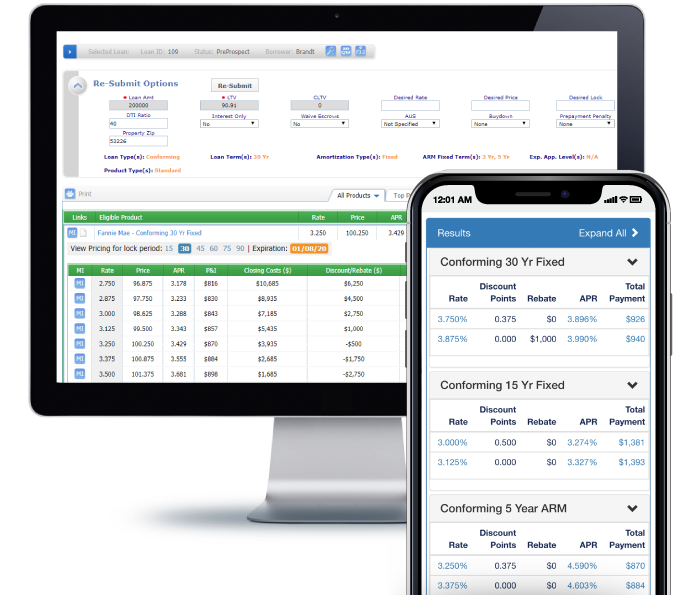

Product Pricing Engine Mortgage Ppe For Lenders Optimal Blue

Conforming Loans The Mortgage Lady

Non Conforming Loans How Do They Work Rocket Mortgage

Non Conforming Loans Mortgage Lending Options Axos Bank

Conforming And Non Conforming Loans What S The Difference

Non Conforming Vs Conforming Blog Missouri Usa Mortgage

Difference Between Conforming And Nonconforming Loans Bankrate

.png)

Mother Son Realty Group

Difference Between A Conforming And Non Conforming Loan

Amo Non Conforming Loans Mortgage Specialist Australia

Conforming Vs Non Conforming Loan Which Is Best For You Forbes Advisor

What To Know About Non Conforming Loans

Oaktree Funding Non Prime Select Guidelines